In the rapidly evolving landscape of cryptocurrencies, Bitcoin remains a dominant force, captivating the attention of investors and miners alike. At the heart of this digital revolution lies the mining machine—an intricate device designed to mine cryptocurrencies, validate transactions, and secure the blockchain. Among the myriad of options available, Alephium ASIC miners have carved a niche, offering unparalleled efficiency and power. This article explores the competitive edge that Alephium brings to the Bitcoin mining machine market.

Mining Bitcoin isn’t just about crunching numbers with brute force; it requires precision engineering and innovative design. Alephium ASIC miners utilize a unique architecture that optimizes power consumption while maximizing hashrate. This duality is crucial, as the profitability of mining operations hinges on energy efficiency and the ability to process transactions swiftly. With growing energy costs, miners are more than ever on the lookout for machines that can deliver high performance without a corresponding spike in electricity bills.

Furthermore, the community surrounding Bitcoin mining is fiercely competitive. Miners must invest in not only the right equipment but also in hosting solutions that can foster optimal performance. That’s where mining machine hosting services come into play. These services provide the infrastructure and environment necessary for miners to thrive while ensuring the continuous operation of their rigs. Hosting allows miners to bypass the overhead costs of running a mining farm independently, thus maintaining competitiveness in this fast-paced market.

Alephium ASIC miners excel in hosting scenarios. Their robust design means they can withstand the rigors of continuous operation, a fundamental requirement in the mining world. Moreover, since these miners are built to be compatible with various hosting facilities, potential users have the flexibility to choose operations that suit their specific needs. Such versatility is crucial as global mining dynamics shift, revealing how central location can impact profitability significantly. A miner operating in a jurisdiction with lower electricity costs stands to gain an advantage over competitors in more expensive regions.

But let’s not overlook the competitive landscape of other cryptocurrencies, notably Ethereum (ETH) and Dogecoin (DOG). As straightforward as mining Bitcoin may seem, the strategies employed can span across different coins, whose mining processes can vary. As Ethereum transitions to proof-of-stake, however, miners are flocking to alternative coins like Dogecoin, which remains accessible via traditional mining rigs. This broadens the market for miners—investing in versatile ASIC machines that can mine multiple currencies may yield better returns as opportunities shift.

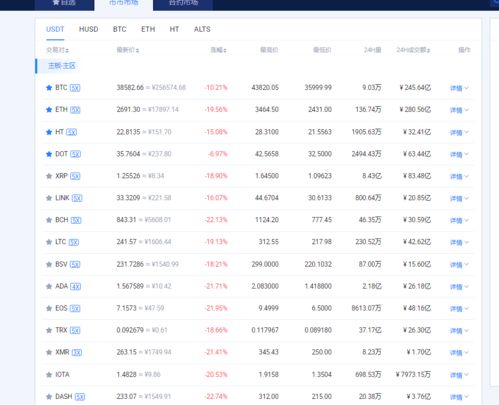

Another pivotal aspect to consider is the role of cryptocurrency exchanges in this ecosystem. The choice of exchange can extensively affect a miner’s profitability. Some exchanges offer better rates, reduced fees, and enhanced security, whereas others may focus on altcoins and new projects. Miners often need to strategically select where they sell their mined coins, meaning that the integration of hardware performance with trading strategy becomes crucial.

Moreover, with the decentralized technology at the heart of Bitcoin, each miner contributes to a larger, collective effort of maintaining network integrity. The Alephium ASIC miners operate on this principle—while they may seem tactical tools, they are, in fact, integral cogs in the battle for a more decentralized and fair digital marketplace. As more miners join the fray, it becomes evident that collaboration, both in hardware choice and community engagement, will dictate the future of not just Bitcoin, but the entire cryptocurrency domain.

Yet, potential entrants into the mining arena should also weigh the environmental implications. The mining process, particularly of Bitcoin, has faced scrutiny over its energy consumption. Hence, companies that emphasize sustainable mining practices or develop machines that significantly reduce power demands could filter into a competitive edge. Alephium’s innovations potentially place it ahead of the curve by addressing these concerns directly through next-gen technology.

In summary, the allure of Bitcoin mining, combined with the efficiency of Alephium ASIC machines, presents a fascinating landscape for both seasoned miners and newcomers alike. The way miners adapt—be it through machine choices, effective hosting solutions, or strategic sales practices—will ultimately influence their success in this competitive arena. As cryptocurrency evolves, so too must the strategies employed by miners, ensuring they remain agile and ready to seize opportunities at a moment’s notice.

FrostGlow

Alephium ASIC promises efficiency, but profitability hinges on price and network difficulty. A niche contender challenging established Bitcoin mining giants. Worth watching!